Indian market hit a wall in March as fears over rising cases of coronavirus threatened to push the global economy into a recessionary phase. Relentless selling by foreign investors in March shaved off more than Rs 30 lakh crore of investor wealth in a single month.

This is probably one month that investors would like to strike off from the calendar. Many mutual fund investors saw their portfolios lose value every single day.

The S&P BSE Sensex and the Nifty50 fell about 23 percent each to post their worst fall since October 2008. Investors lost more than Rs 33 lakh crore in a single month as the average market capitalisation of BSE-listed companies fell from Rs 146.87 lakh cr on Feb 28 to Rs 113.48 recorded on March 31.

The large part of the fall was led by consistent selling by foreign investors who have pulled out more than Rs 60,000 crore from Indian equity markets from the cash segment so far in March, provisional data showed.

With 21 days of lockdown in India and a complete halt of economic activity across the globe due to rising cases of COVID-19 has fueled fears of economic recession, one of its worst seen in the last 150 years.

In an exclusive interview with CNBC-Tv18, former IMF chief economist Kenneth Rogoff said that “We are going to have a giant recession this year. The depth of the recession will be lot large at the high end of the 100 worst recessions the whole world has experienced in the last 150 years,” he said.

In tandem with the global markets, D-Street witnessed one of its worst month in the last 12 years. More than 90 percent of the Nifty50 stocks hit a fresh 52-week low or multi-year lows in the same period.

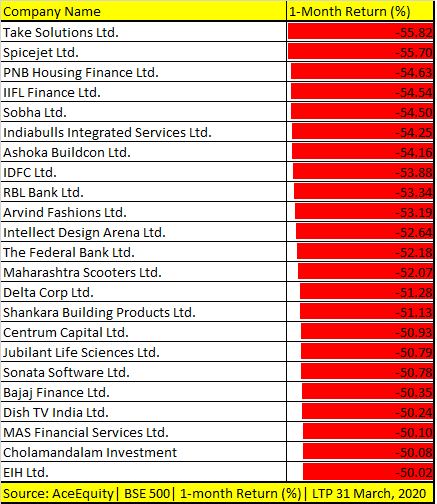

However, the bigger carnage was seen in individual stocks. As many as 43 stocks in the BSE500 index fell over 50 percent in the month of March.

Stocks that shaved off more than half of their value include names like Dish Tv India, AU Small Finance Bank, KPIT Technologies, Repco Home, Ujjivan Financial, Welspun Corp, IndusInd Bank, and Future Retail.

No comments

Post a Comment