New Delhi: In a yet another relief measure in the wake of Coronavirus outbreak and the 21-day nationwide lockdown, the Central government announced to extend the validity of forms 15G and 15H by three months to June 30, 2020. According to reports, the government has directed banks not to deducted TDS on interest income of individuals.

The announcement was made on Saturday by a senior official of the All India Bank Employees' Association (AIBEA).

The issue was taken up with the Central Board of Direct Taxes (CBDT) after the union was approached by several bank retirees and pensioners asking for an extension of the timeline.

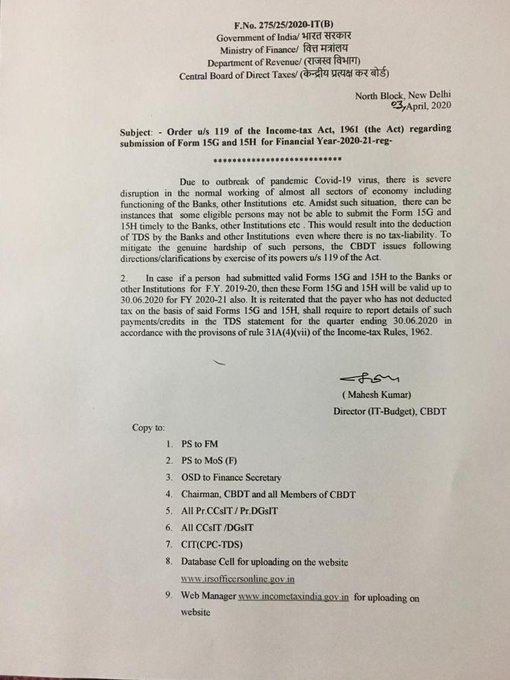

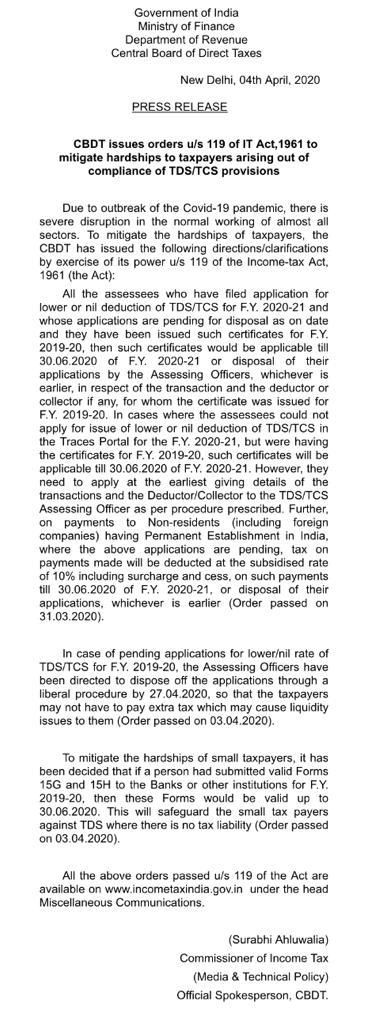

To mitigate the hardships of small taxpayers, CBDT has issued an order stating that if a person had submitted valid Forms 15G and 15H to the Banks or other institutions for F.Y. 2019-20, then these Forms would be valid up to 30.06.2020. #IndiaFightsCorona #StayHomeStaySafe

This step will safeguard the small tax payers against TDS where there is no tax liability .

For more detailspib.gov.in/PressReleseDet…

55 people are talking about this

As per an order issued by the CBDT late on Friday, if a person has submitted valid forms 15G and 15H to the banks and other institutions for financial year 2019-20, then these forms will be valid up to June 30 for FY2020-21 also.

Form 15G and Form 15H are forms you can submit with a bank to prevent TDS deduction on your interest income. These forms are normally submitted at the beginning of the financial year.

CBDT issues orders u/s 119 of IT Act,1961 to mitigate hardships to taxpayers arising out of compliance of TDS/TCS provisions.#IndiaFightsCorona #StayAtHome #StaySafe#WeCare@nsitharamanoffc@Anurag_Office@FinMinIndia

165 people are talking about this

This ensures the bank does not deduct any TDS on your interest income. Most banks deduct TDS every quarter. Apart from interest income on bank instruments, TDS also applies on EPF withdrawal, income from corporate bonds, on post office deposits, on rent and on insurance commission.

The banking union had earlier stated that it would be difficult for Fixed Deposit (FD) holders to submit the forms in bank branches during the lockdown.

He specified that the clarification is applicable for all depositors of banks and other institutions.

Meanwhile, Venkatachalam also requested the government to grant leave to those bankers developing symptoms of Covid 19 and suggest 14 days leave or quarantine, and also if anyone is affected by the disease being on duty and to count the hospitalisation period as special leave.

In an attempt to ease tension, the government had already extended tax-related deadlines between 20 March and 29 June till 30 June. Even the deadline to link PAN with Aadhaar has been extended till June 30, 2020 whereas the earlier deadline was March 31, 2020.

(With inputs from agencies)

#StayHome #StaySafe

#StayHome #StaySafe

No comments

Post a Comment